Why Choose First Step Savings?

Plant the seeds for financial growth early with our First Step Savings Account, specially designed for children from 0 to age 6. At Park City Credit Union, we’re here to help young savers take their first steps toward a strong financial future.

Choices within this program:

My First Certificate

Additional Features for Children and Parents

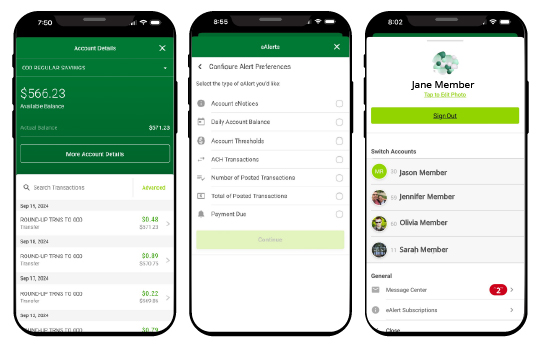

Fun and Powerful eServices!

Empower your child’s financial journey with these exciting digital tools:

Ready to Get Started?

Open a First Step Savings account today and give your child a head start on building healthy financial habits that will last a lifetime.

Schedule an Appointment Today!

Our team is here to help you open an account and answer any questions.

*APY=Annual Percentage Yield. APYs accurate as of 10/14/2024. Rates may change after account is opened. The minimum to open account online is $5.

¹For Youth Savings: (1) balances up to $500 receive APY of 2.00%; and (2) balances over $500 earn 0.01% dividend rate on the portion of the balance over $500, resulting in 0.81%-6.00% APY depending on the balance. Primary owner must be 17 years old or younger to open an account. Limit one account per primary Owner’s SSN.

²The minimum to open account is $500. A penalty may be imposed for early withdrawal. Primary owner must be 17 years old or younger to open an account and under 21 to renew.

³Minimum Add-on Deposit is $20.00.

⁴Custodial account refers to the Uniform Transfers to Minors Act (UTMA).

⁵Wireless carrier data rates/fees may apply.

Credit terms & conditions, and other restrictions may apply.

Park City Credit Union provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by Park City Credit Union, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL