Why Choose Teen Spend and Save?

Give your teen the tools to build financial independence with our Teen Spend & Save Program, designed for ages 14 to 17. At Park City Credit Union, we empower teens to learn smart saving and spending habits while providing parents with the oversight needed to guide them.

Teen Dreams Certificate

Teen Cash Back Spending Account

Quarterly Round-Up Drawing8: A fun incentive for saving-members are automatically entered when they have a round up transfer.

Additional Features for Teens and Parents

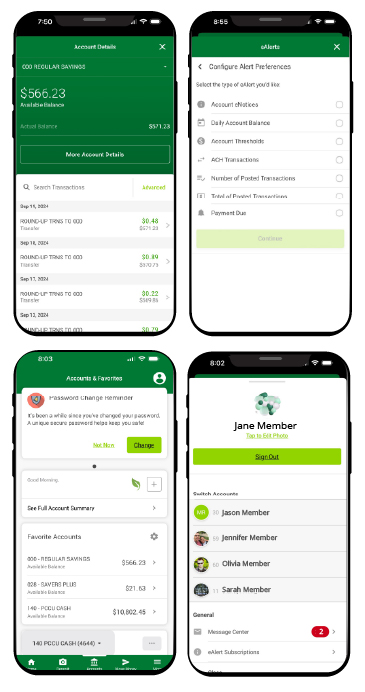

Fun and Interactive eServices

Make financial management exciting with these digital tools:

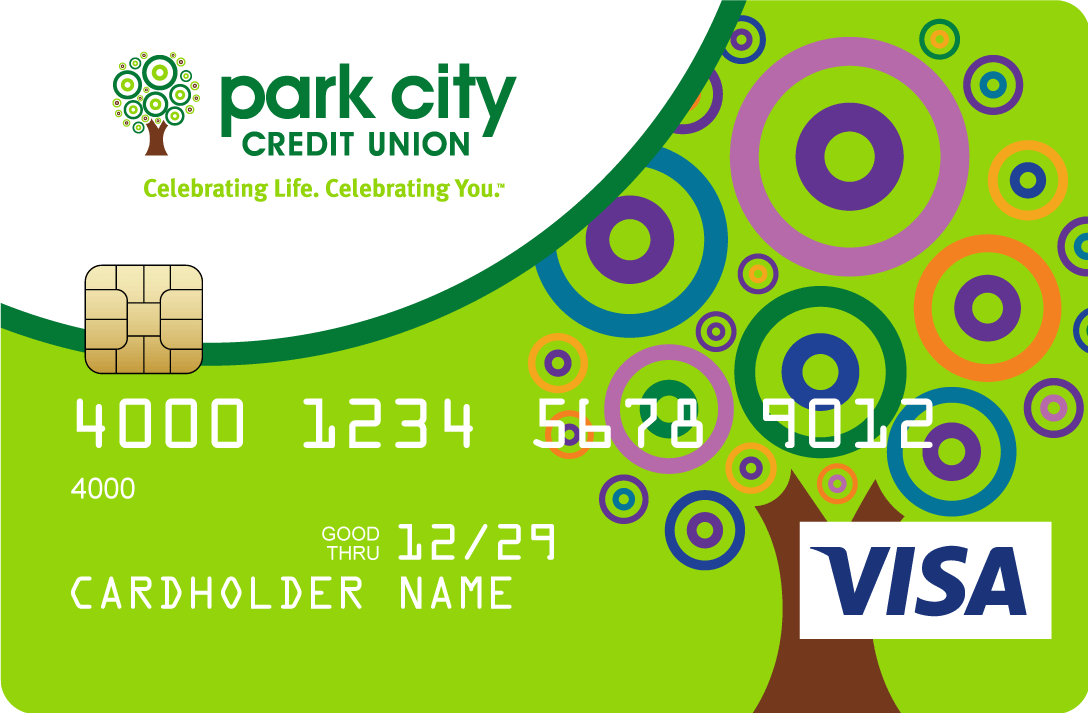

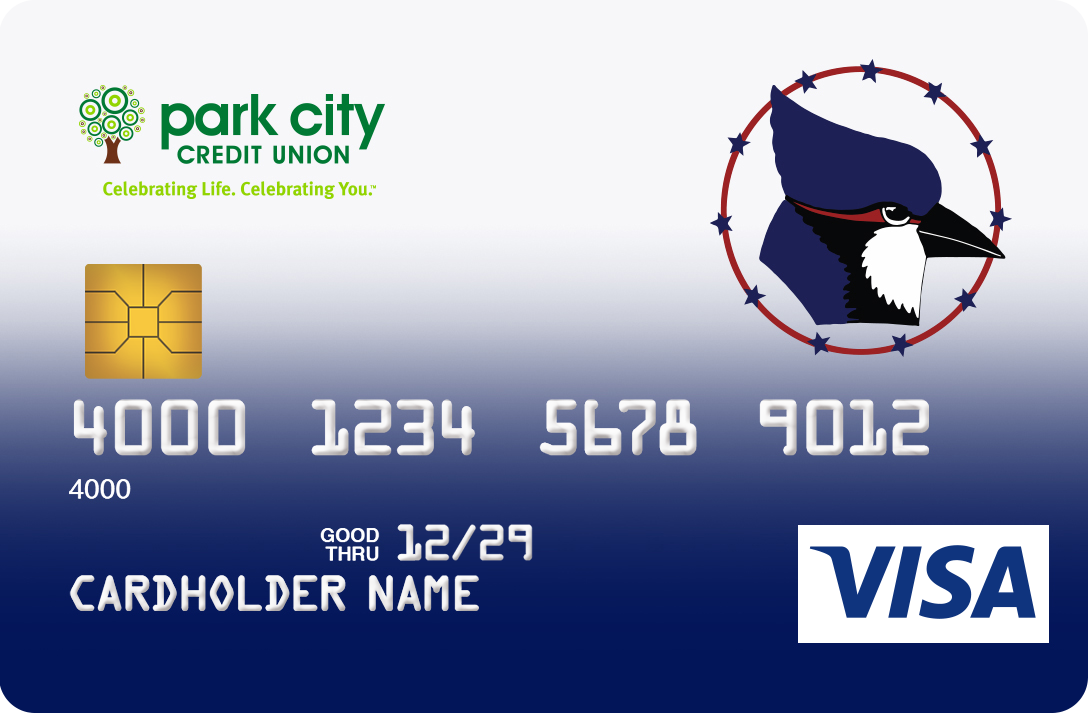

Explore Our Debit Card Designs

Teens can choose from 7 unique debit card designs. Check out your options below:

Youth Savings

My First Certificate

Junior Investor Certificate

Junior Spending Account Features

Access to Banzai Youth Financial Wellness Center: Interactive resources to build strong financial habits.

Ready to Get Started?

Help your teen build financial independence and confidence today with an account tailored just for them.

Schedule an Appointment Today!

Our friendly team is here to help you open an account and answer your questions.

11For Youth Savings: (1) balances up to $500 receive APY of 2.00%; and (2) balances over $500 earn 0.01% dividend rate on the portion of the balance over $500, resulting in 0.81%-6.00% APY depending on the balance. Primary owner must be 17 years old or younger to open an account. Limit one account per primary owner’s SSN.

12The minimum to open account is $500. A penalty may be imposed for early withdrawal. Primary owner must be 17 years old or younger to open an account and under 21 to renew.

13Minimum Add-on Deposit is $20.00.

14The minimum to open account is $100. A penalty may be imposed for early withdrawal. Primary owner must be at or between the ages of 7 and 17 years old to open an account and under 21 to renew.

15Minimum Add-on Deposit is $20.00.

Park City Credit Union provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by Park City Credit Union, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL