Why Choose Junior Spend and Save?

Help your child take the next step in their financial journey with our Junior Spend & Save Program, designed specifically for kids aged 7 to 13. At Park City Credit Union, we’re here to support growing savers and spenders by providing tools to build financial independence and confidence.

Junior Investor Certificate

Junior Spending Account Features

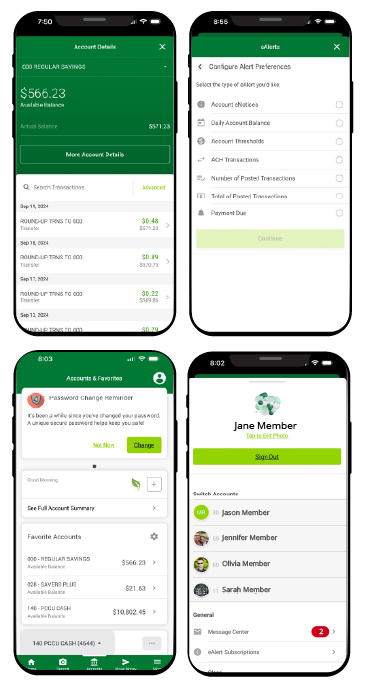

Fun and Powerful eServices!

Empower your child’s financial journey with these exciting digital tools:

Additional Features for Teens and Parents

Access to Banzai Youth Financial Wellness Center: Educational resources to help teens learn essential financial skills.

Youth Savings Account

My First Certificate

Ready to Get Started?

Empower your child with the tools they need to save, spend, and grow their money responsibly.

Schedule an Appointment Today!

Our friendly team is here to help you open an account and answer your questions.

*APY=Annual Percentage Yield. APYs accurate as of 10/14/2024. Rates may change after account is opened. The minimum to open account online is $5.

3Apple Pay® is a registered trademark of Apple Inc. Google Pay™ is a registered trademark of Google LLC. Samsung Pay® is a registered trademark of Samsung Electronics Co., Ltd.

5Must qualify for mobile deposit in order to enroll. Wireless carrier data rates may apply.

6Park City Credit Union’s Debit Card Round Up program requires a qualifying checking account with Visa® debit card. Actual savings will vary based on debit card use. The program is not available for Health Savings Accounts, Platinum or Gold Money Market, UTMA/Custodial or Business/Organizational Checking. Each rounded amount will be between $0.01 and $0.99. Transfers will be completed in one lump sum at the end of each day. The credit union reserves the right to cancel or modify the Debit Card Round Up program at any time.

7Park City Credit Union’s Debit Card Round Up Program requires a qualifying checking account with Visa® debit card. Actual savings will vary based on debit card use. The program is not available for Health Savings Accounts, Platinum or Gold Money Market, UTMA/Custodial or Business/Organizational Checking. Each rounded amount will be between $0.01 and $0.99. Transfers will be completed in one lump sum at the end of each day. The credit union reserves the right to cancel or modify the Debit Card Round Up program at any time.

8Wireless carrier data rates/fees may apply.

10For Youth Savings: (1) balances up to $500 receive APY of 2.00%; and (2) balances over $500 earn 0.01% dividend rate on the portion of the balance over $500, resulting in 0.81%-6.00% APY depending on the balance. Primary owner must be 17 years old or younger to open an account. Limit one account per primary owner’s SSN.

11The minimum to open account is $500. A penalty may be imposed for early withdrawal. Primary owner must be 17 years old or younger to open an account and under 21 to renew.

Park City Credit Union provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by Park City Credit Union, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL